If you need to be completely sure of your credit score, you may want to pay to have it printed out. One company does exactly that — read on for a Credit Check Total review.

One reason may be that the review writers are accustomed to free credit checking services and forget to unsubscribe after they finish the free trial. Then when they are charged the monthly fee after the seven-day trial, they aren’t able to get their money back, and that causes them to take to the internet with complaints.

Credit Check Total Review

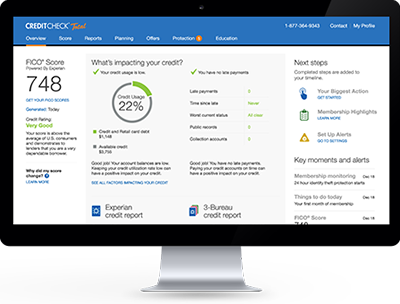

Credit Check Total is an Experian company. The first credit check only costs $1 and you’ll get your scores from the three credit bureaus. This will essentially begin a seven-day trial membership with Credit Check Total. After seven days, if you have not canceled, you will be billed $29.95 per month.

To cancel your Credit Check Total service, you will have to call 1 (877) 284-7942 before the billing date. Remember that the company operates on Pacific Standard Time during these hours:

- Monday through Friday: 6 a.m. to 6 p.m.

- Saturday and Sunday: 8 a.m. to 5 p.m.

One of the only perks of Credit Check Total is that they give you identify theft monitoring services with your $29.95 monthly fee. You can set up a lost wallet protection feature for yourself as well, which prompts the credit company to cancel your credit and debit cards for you.

Why Not Go With a Free Service?

Many people will find that Credit Check Total’s services don’t add up to enough to justify paying $29.95 a month. There are a number of completely free credit checking options out there.

Frankly, Credit Karma is one of the easiest, cheapest, and one of the most accurate ways to keep track of your credit score. Another great thing about Credit Karma is that the company updates your score once every week. The ability to see it that often is especially encouraging for anyone who is actively working on paying off debt.

When it boils down to it, Credit Check Total likely isn’t worth the money. A much better use for $30 a month: Put it in an investment account. Then monitor your credit with a free, or much cheaper, service.

If you need a one-time credit report printout just before applying for a mortgage loan, Credit Check Total is a perfectly fine choice. Just don’t forget to cancel before the first week is up or you’ll wind up paying $30 to pull your credit.

Readers, how often do you check your credit score or credit reports — and which service do you use for that?

You may also check these articles:

- How To Pay For Plastic Surgery With Bad Credit?

- Buy An Oil Well?

- 4 Key Components Of Financial Planning

- The 10 Most Expensive Court Cases In History

Checking your score is important, though I agree with so many free options around, it may not make sense to pay a fee to do so. One of my credit cards offers credit monitoring as a free service, which is a great option. The only downside is that it only covers one of the three credit reporting bureaus, not all three.

Pingback:5 Challenges Women Face in Retirement - Dual Income No Kids | Dual Income No Kids

Pingback:How to Make Money as an Amateur Photographer - Dual Income No Kids | Dual Income No Kids

Pingback:What Is Kimbal Musk’s Net Worth? - Dual Income No Kids | Dual Income No Kids

Pingback:How Much Interest Does 1 Million Dollars Earn Per Year? - Dual Income No Kids | Dual Income No Kids

Pingback:Building Wealth On $600 Per Month - Dual Income No Kids | Dual Income No Kids

Pingback:Nine Ways to Make Extra Money (Updated for 2017) - Dual Income No Kids | Dual Income No Kids

Pingback:Crash Course: Mutual Funds for Beginners - Dual Income No Kids | Dual Income No Kids

Pingback:DINKS (Dual Income No Kids) – Smart or Selfish? | Dual Income No Kids

Pingback:7 Degrees that Teach You About Managing Money - Dual Income No Kids | Dual Income No Kids

Pingback:The Ten Most Expensive Court Cases In History - Dual Income No Kids | Dual Income No Kids

Pingback:Let Student Loan Defaults Go, Report Argues - Dual Income No Kids | Dual Income No Kids

Pingback:Are You Truly Financially Secure? - Dual Income No Kids | Dual Income No Kids

Pingback:Are you a DINK cliche? Take the Test. | Dual Income No Kids

Pingback:It is really not worth it to rob a bank, just get a regular job! | Dual Income No Kids

Pingback:The pros and cons of investing in mutual funds | Dual Income No Kids

Pingback:Considerations when investing in stocks | Dual Income No Kids

Pingback:Retirement Confidence Is Increasing – But Should It Be? - Dual Income No Kids | Dual Income No Kids

Pingback:Are Smart People Richer? - Dual Income No Kids | Dual Income No Kids

Pingback:10 Ways to Make Money From Your Home In 2019 - Dual Income No Kids | Dual Income No Kids

Pingback:Building Your Credit Score

Pingback:Look to Start the New Year with Improved Credit

Pingback:Maintaining a Good Credit Score: Are Soft Credit Inquiries Harmful in Any Way?

Pingback:Hunting does not build wealth | Dual Income No Kids

Pingback:Use a Credit Card for All Purchases? - So Over This

Pingback:Ways You Are Hurting Your Credit Score | Edward Antrobus

Pingback:Millennials Can Teach a Thing or Two about Being Financially Responsible

Pingback:6 Ways to Jump Start Your Credit Score

Pingback:Why You Need to Check Your Credit Report

Pingback:An Honest Credit Check Total Review - Dual Income No Kids | Dual Income No Kids

Pingback:How I Grew My Net Worth in 1 Year - Dual Income No Kids | Dual Income No Kids