Okay, so I sat down and updated my net worth this week.

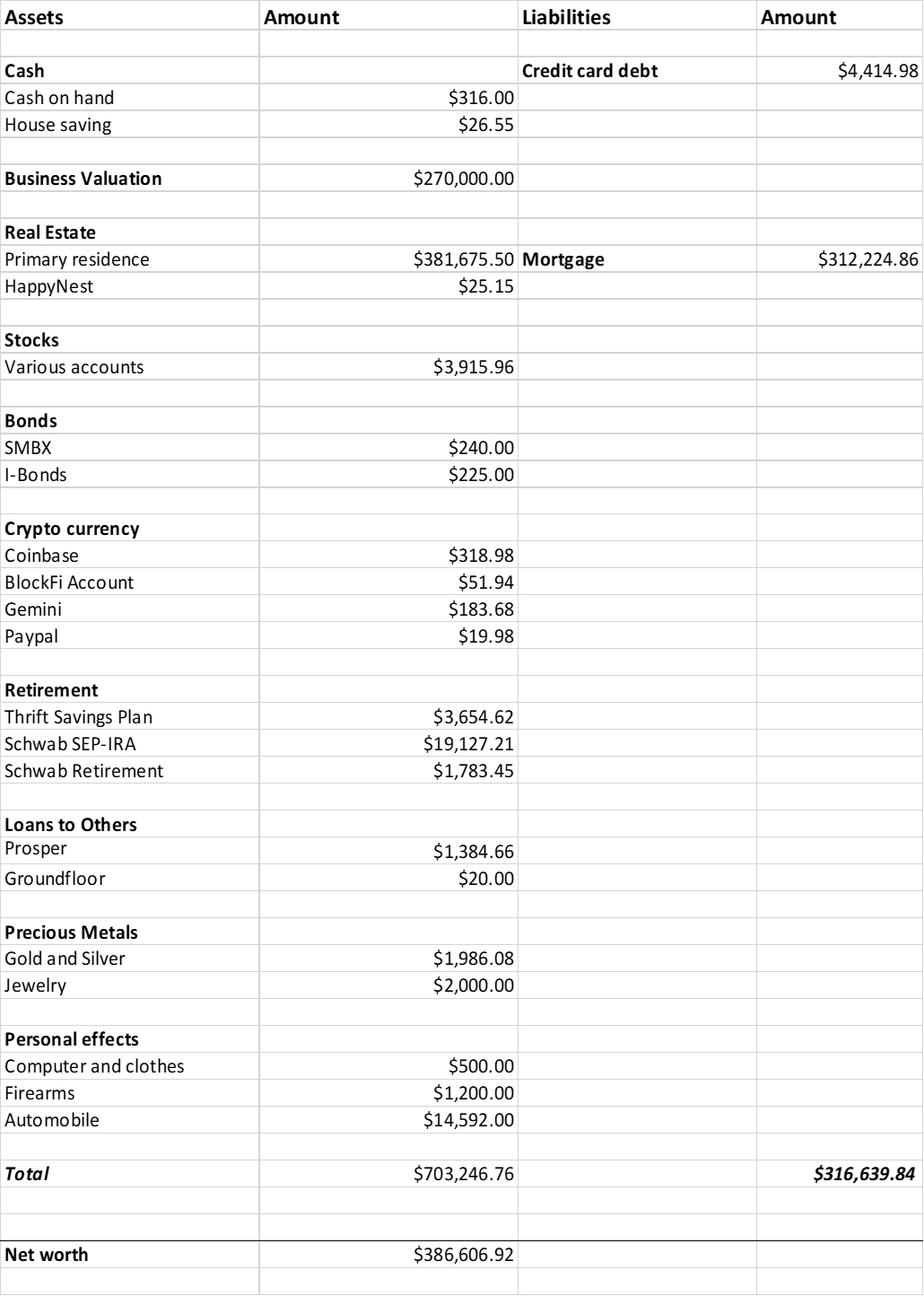

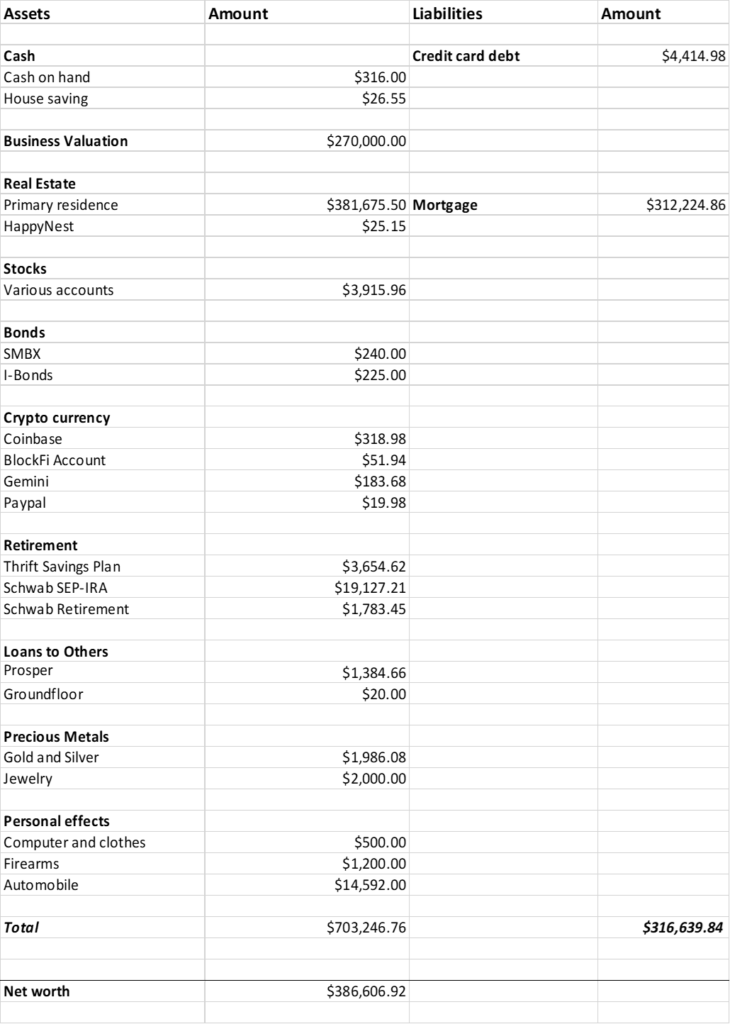

My total net worth for December 2021 sits at around $386,000. The major components of this are my online business, home equity, some stock, and some other assets.

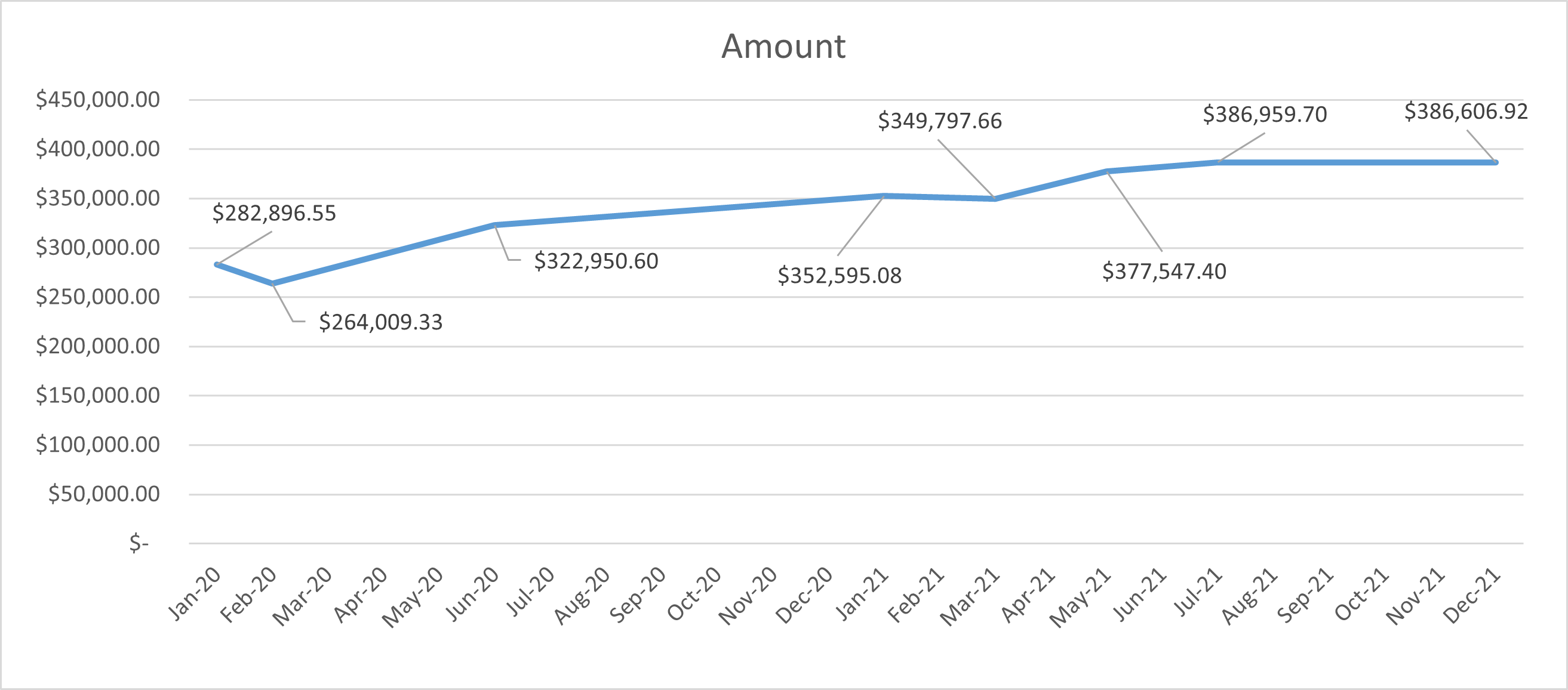

My wealth is pretty much like a drooping houseplant at this point. It’s flatlined over the last few months. I’ve got more bonds, crypto and shares of stock than at the start of the year, but the markets have downturned. Also the value of my condo in Portland has declined a bit.

Here is the growth trajectory from January 2020 of last year until now.

Where To Go Next?

There are a couple of things I’m mulling over. The main thing is building up an emergency fund. Not having an emergency fund has cost me in the past when I’ve had vehicle trouble and haven’t had the cash to cover the expense. Also, I’m planning on moving out of Portland. Crime in the city has frankly gotten a lot worse and the city is addicted to taxes. Also, Portlanders seem to prefer insane and self-destructive political policies. So, having a lot of cash on hand would help reduce my risk and get me someplace sane.

Inflation Is Here, Don’t Have A Good Solution

Inflation is becoming a problem. The Fed calculated that inflation for most of 2021 was 6.2% (here). It’s likely that the rest of this year won’t be much better. Unfortunately, I’m not optimistic about 2022. Bloomberg is reporting that the CPI is expected to increase between 2% and 5% in 2022, via Crainscleveland.com. What this means is that dollars you were holding at the start of 2020 will likely be worth 10% less in 2022.

The dilemma I’m thinking through now is, current inflation levels mean that any cash I save is going to lose a substantial portion of it’s value. Options that keep pace with inflation like I-bonds (7%), or lending via crypto (8%) introduce liquidity and risk issues.

A smaller emergency fund – about $1,000 – makes sense, but keeping any kind of sizeable cash holding means that cash will take a substantial haircut. Most of the commercially available options, like Treasury Inflation Protected Securities (TIPs), TIPs funds or gold seem like they’d be illiquid or the real returns would be poor. There are some inflation protected bank accounts (per CNBC), but they seem gimmicky.

I don’t have a good solution to the inflation challenge at the moment.

Living Off The Financial Land

What has been going well are several things. These all fit under the category of “living off the financial land”. So basically, doing more with less, living frugally, and learning to utilize available opportunities.

1. Cutting costs. I’ve cut way back on my discretionary spending. I’ve basically stopped eating out, haven’t been to a movie in ages and have pretty much obliterated my entertainment budget. The reality is I like not spending money. My skill sets in terms of DIY problem solving has gotten a lot better and I’ve become a more skilled shopper.

2. Receipt Scanning. I’ve also started scanning all my receipts. I have like ten apps on my smartphone that I use to get cash back, scan my receipts for points or otherwise shave a percentage or two off my budget.

The apps are:

1. Ibotta

2. Fetch

3. Coinout

4. ReceiptJar

5. Pogo

6. ReceiptPal

7. ReceiptHog

8. Bitmo

9. The Amazon Shopper Panel

10. Drop

Using all of these together means I can effectively shave about 1% off my grocery bill or other expenses. Most of these pay points or a couple of cents back. However, I’ve been using them consistently for a few months and the results are starting to add up. I was able to get some of my Christmas shopping done without paying cash – I used Amazon credit from these apps.

I’m actively looking for more apps. These are just what I’ve identified so far.

3. Passively selling my data.

Data has economic value. Per Statistica, the value of the big data market is expected to grow to 103 Billion in 2027 (1). A lot of the major social media companies – like Facebook, Google and Netflix derive a substantial amount of their revenue from data. And major corporations like McDonalds, Unilever, Toyota, and Home Depot buy data to improve their marketing. What this also means is that an increasing variety of companies will pay you for your data. These companies typically buy geolocation data, spending history, social media activity, and demographic profiles. Most of the time they pay you a small amount in return for your data – between $3 and $5 per month.

I’ve loaded up on all the legit data brokerage companies I could find.

These ones work:

Invisibly (Note: inactive as of 7/7/2022).

A lot of people are squeamish about selling their data, but big tech is already legally getting it from you, so you might as well get your share of the money. I’d sign up with all of these and start getting paid.

4. Hustling referrals. For a while I was working the free stock referral game pretty hard. It got the point that my friends were tired of me asking. Whats crazy is that a lot of people I asked didn’t want free stock. What? You don’t want appreciating assets? Or a stream of passive income?

The major barrier may be that people don’t understand the value of owning shares. Or they don’t understand how stock markets work. In any event, there are five decent brokerages that actually give you free shares of stock for signing up.

I’d work the list and sign up for ALL these brokerages. As an asset class, stock performs better than cash or bonds under almost all economic conditions. Having it is well worth any administrative hassles more than one account presents.

So, these are the four things I’ve been working on the past couple of months. The thing I like about each of these is that they’re all easy. So, if you’re looking to add some cash to your accounts, I’d work these options.

For more wealth updates, read these:

James’s July 2021 Wealth, Up $9,377 to $386,959

James’s March Net Worth Update

If you want to build your own wealth, here are some good basic reads.

Building Wealth On $600 Per Month

Nine More Ways To Make Extra Money

When Is The Best Time To Buy and Sell Mutual Funds To Make The Most Money

Here is an in depth review of a nice little bond market called SMBX. Do yourself a favor and buy some bonds.

SMBX: Bonds for Socially Conscious Investors With an Appetite for Risk

Disclaimer: Some of these links are referral links. This means that if you sign up or buy through the link, Dinksfinance will get a commission. I am disclosing this per applicable FTC regulation.

Im not so optimistic about the 2022 being any better than this year sir. But lets hope it gets better. Inflation was said to be 6.2%? Im calling that a big fat lie! Inflation is out of control. I don’t know why the FED has too lie about it. Im definitely going to be looking into putting more money into SBMX and Groundfloor in the upcoming year. Can’t beat passive income cash.

Beau

So, I actually really like SMBX. They have an interesting model that lets small businesses leverage the internet to improve relationships with they customers (e.g. SMBX helps customers buy bonds of businesses they are already involved with). However, the maximum interest their bonds pay is about 7%. My rough back of the envelope suggests that’s going to just keep pace with inflation – which means you’re taking a lot of risk just to have your money hold its value.

Have you considered alternatives like I-Bonds or TIPS?

To be clear, I like and will keep investing with SMBX, and I’m also looking at I-bonds a lower risk inflation protection option.

On referrals, free stock is nice but there is an overhead of your time and keeping all your accounts organized, passwords. As accounts grow, now you more tax forms flowing in. 10 yrs later, you’ll look back and understand that a $5 stock wasn’t worth setting up a new account. The goal is to have one taxable brokerage with at least $5.000 (you start becoming eligible for more advanced account features and trading methods). Trust me when you grow one account to $100,000, you’ll be happy to delete all the others with $9 in them.

On your valuations, your current networth is due largely to your business valuation. Only you know this but if that value is incorrect, you would be closer to a zero networth. A business may be worth 270k to you but if you had to sell it, it may fetch a lot less. So a business value is illiquid. So stay healthy and keep that business going!

Also, a loss in real estate value!? That is alarming! I live in Denver where home values have gone up 15% year over year, competing with the stock market. Demand for housing remains high and it has been a sellers market for about 10 +years now. So get out of Portland!!!

Hey Aaron, good points. I had considered the extra accounting issues with having multiple accounts. That said I’m cool with having $10 or $20 bucks in an account, as long as its paying dividends. That’s because in several years, if the account is paying dividends it’s going to be worth may more than nine bucks.

Regarding Portland – yep, our building has been broken into six times. The trick is coming up with the money to make a move economically feasible, as I’d like to convert this current condo unit into an apartment.