Looking for ways to make some extra money? We thought it would be fun to share some things we’ve done to make extra money on the side.

We’ve continually updated this posting, so its way more than 9 ways, we just don’t want to change the graphic.

1) Do Surveys:

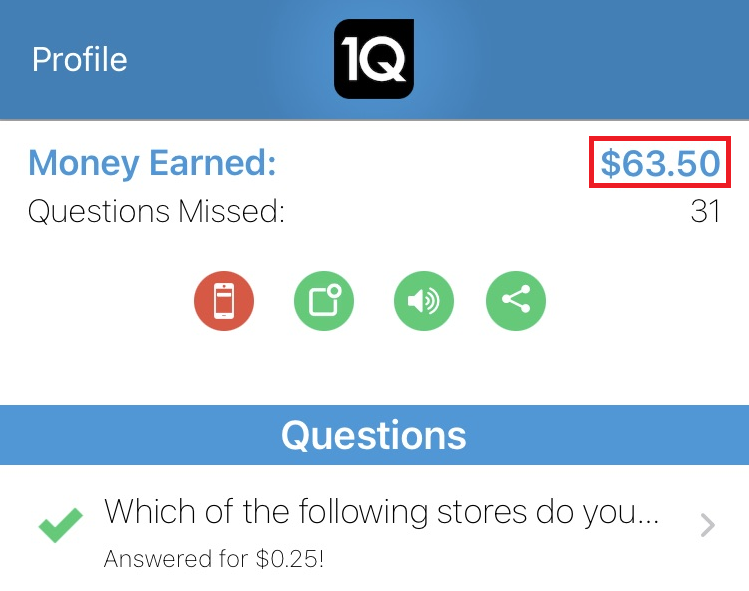

This is a classic. Doing surveys won’t make you rich, but it’s a good way to get a little bit of extra residual income in your spare time. Plus if you dump the money into a retirement account, you could be eligible for the savers credit. Most of the survey companies don’t pay well at all. An exception is 1Q. They pay 25 cents per QUESTION, which is about ten times more than other apps pay. They also payout right away to Paypal, which is excellent. Money in your accounts today is worth more than money in your accounts tomorrow.

Definitely get this app.

2) Invest For Income:

For a while we DINKs held stock in Exxon Mobile and Johnson Controls through a dividend reinvestment program. We got in initially for around $250 bucks for each of these stocks, and enjoyed a modest, but noticeable dividend. Most recently I’ve been buying bonds via SMBX – which is a nice solid way to pick up a few extra bucks a month.

Edit: 2025. In 2022 the brokerage industry has changed a lot, there is a ton of venture capital money sloshing around in the stock market. As a result, several companies are now offering “get paid to sign up” type offers. Basically, these companies are offering a trade. You sign up and link your bank account, and in return you get a share of stock or two. There are two that don’t require you put money into their system. These are:

Of these Robinhood is the best. It has very fast execution and delivers on its promises.

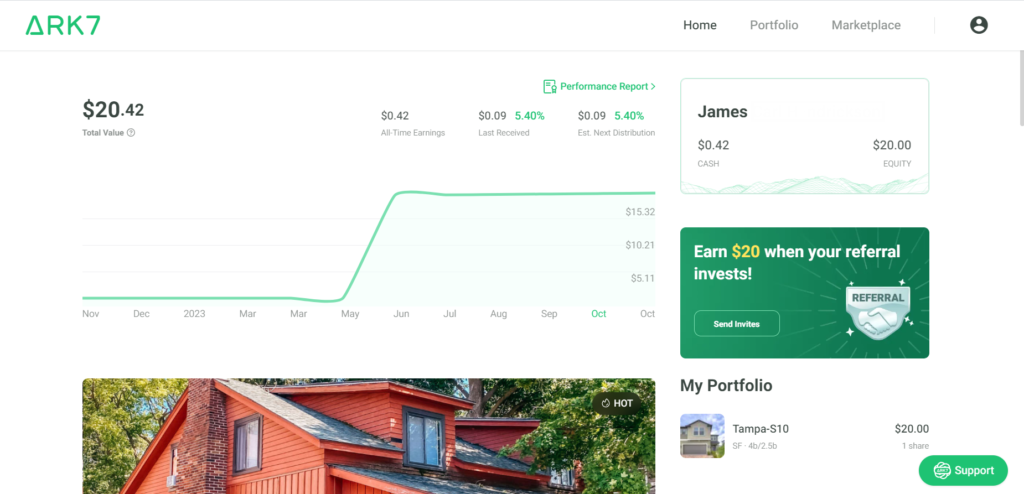

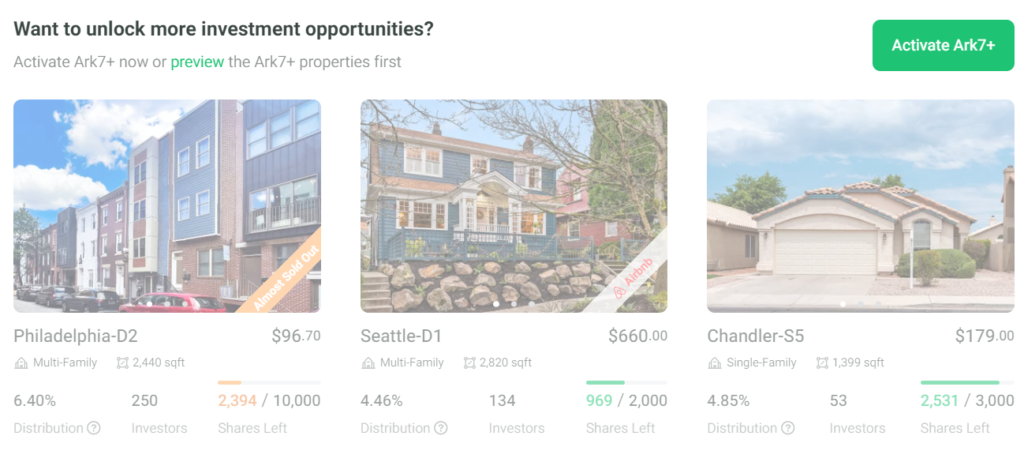

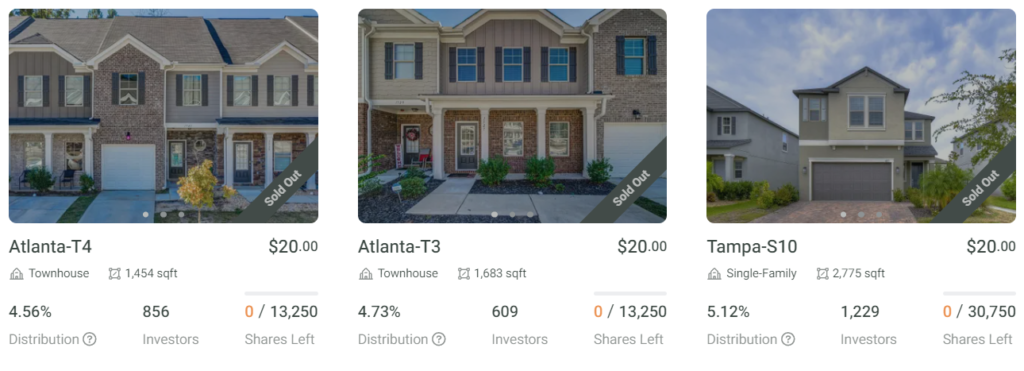

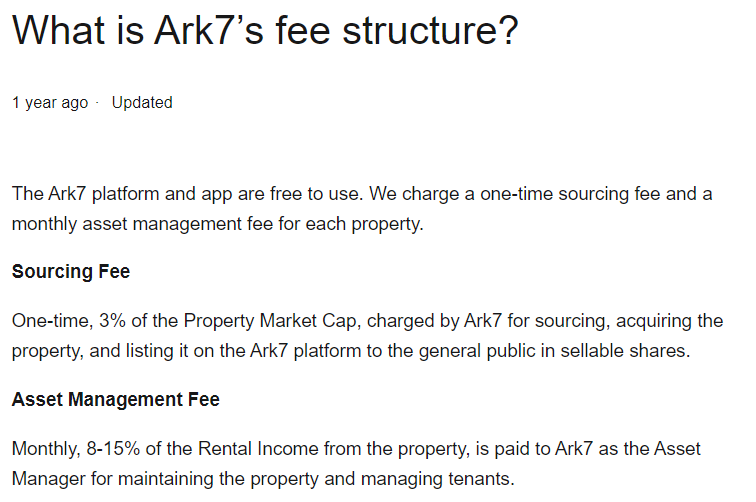

Oh, as a side note another good fintech app which I actively us is Ark7. They’re a neat little fractional ownership of real estate app. These kinds of app are good if you don’t have enough money to buy a house yourself, but you want the passive income that comes from owning real estate. You can sign up for them here.

3) Hold a Garage Sale:

Back in 2006 we cleaned out the closets, called a couple of friends and put on a yard sale. We ended up getting a couple of hundred bucks. Not a lot, but it reduced the clutter and was a fun thing to do on a Saturday. This hasn’t really been a thing during the pandemic, but its a good way to declutter. You could also try selling your stuff on decluttr.com. If you want a good resource on which items sell better a yard sales, read mystayathomeadventures article on the topic, here.

4) Sell Your Personal Data Online:

Due to regulatory changes in Europe and the U.S., a number of startups are now paying your for browsing history, spending history and demographic data. These payments aren’t much, but they have a couple of upsides. First, they’re totally passive. Once you sign up for the service, you just have to check in and collect every couple of months. Second, these companies generally sell your data to marketers, which is mostly happening without your consent anyways. So you’re not losing much in terms of your privacy. The ones that actually work are:

5) Sell Your Spare Internet Bandwidth:

There are a ton of companies that will buy your spare internet bandwidth for between 50 and 10 cents per gigabyte. What these companies do is set up private proxy networks and sell the bandwidth to businesses for research or other purposes. This is a solid option if you’ve got unlimited bandwidth and want to defer the cost of your internet. They also have the virtue of being largely passive – you just have to check the balances and collect when you have enough revenue.

There are three companies that work reliably:

All of these are worth between $2 and $5 per month.

6) Sell Things on Craigslist or Facebook Marketplace:

A couple of years ago, we found a microwave in the mailroom of our building, we ended up cleaning the thing up, snapping a couple of pictures and putting an ad up on craigslist. The microwave sold the next day for twenty bucks. Not bad. One thing to note here: most of the action is moving from Craigslist to Facebook Marketplace.

7) Negotiate a Raise:

Some people are great about this. What they do is change jobs every two or three years, and each time they change jobs they end up negotiating a raise. Even factoring in taxes and expenses associated with changing jobs, the higher income levels usually make it worthwhile.

8) Start a Blog:

Blogging isn’t what it used to be – there is something like 1 website for every seven people on the planet. At one point we had figured that our hourly wage from working on Dinks was about a $1.85, but hey – it gives us something to do and is a way to have an impact and stay connected. Note as well that our blog income generation has increased as we’ve put energy into doing so.

The great thing about blogs, is you can also sell them. Blogs can sell for something like 5 to 10 earnings, so if you make $100 a year on your site, you could sell it for $500-$1,000. Blogs are also nice because once your site has traffic and you have advertising installed, its pure passive income.

9) Sell Your Body to Science:

If you are in a big city like Washington DC, or Chicago you are in luck. Large research hospitals are typically constantly running a number of research studies. Some of them pay well. We’ve both participated and have been rewarded with some modest checks from the federal treasury for the federal studies we’ve participated in. If you don’t mind being poked and prodded, you can always participate in research studies.

Check your local newspaper or University advertisements.

10) Rent Out a Room:

If you have a spare bedroom in your house or apartment. You might consider renting it out. A bedroom in a decent place can go for $500-$800. The extra bucks could really help improve your bottom line. But, be careful to screen your roommate, you don’t want to get someone messy or a deadbeat who won’t pay your rent! The modern way to do this is via Airbnb.

11) Take Advantage of Grocery Apps:

There are number of good ones. Ibotta is the most common one. How it works is you can either scan your receipts for cash back or you can directly link your loyalty cards to it. This gives you a minimal percentage back – most people get 10 to 20 bucks a month back. Not a lot, but it adds up. Their sign up is pretty easy => check it out here.

The one app that you definitely want to get is the Amazon Shopper Panel. This one gives you .15 cents for each receipt you scan up to $10. That is an excellent rate. As a result, everyone and their mother wants the app, so there is a waiting list. Get it on and try back every week.

12) Sign Up For Class Action Lawsuits:

I regularly sign up for any of these I’m qualified for. We recently got a 90 dollar check from a class action lawsuit regarding using debit cards at BP gas stations. You won’t get immediate cash, but if you work this, you’ll get a couple of hundred extra bucks a year. Consumeraction.org has a pretty solid listing of open lawsuits.

13) Look For Unclaimed Money:

State and local governments administer a fair amount of unclaimed funds. Most of this is just sitting around, waiting to be claimed. So, there is no good reason to not check and see if you’re owed something. The place to check is: The National Association of Unclaimed Property Administrators.

14) Credit Card Cash Back Promotions:

The typical amount in cash back is 1%, if you’re lucky. Certain credit cards like Discover have quarterly promotions that can give you up to 5% cash back in certain categories. Some other cards do promotional cash back quarterly, but if you track the rewards and don’t carry a balance you can get 1 to 3% cash back. Sometimes you can also exchange the cash back rewards for a higher dollar amount in gift cards. This is most lucrative during the holidays. BE SURE TO KEEP YOUR CARD PAID OFF!

15) Drive A Taxi/Do Food Delivery:

In the past couple of years, companies like Uber and Lyft have been good at breaking up local taxi monopolies. Provided your car is in good shape, you can always sign up with one of these companies. Uber in particular has an easy sign up process. They’ve got a couple of options, you can drive an Uber taxi or you could sign up for Uber Eats food delivery service. They won’t make you rich but you can hustle an easy extra $150 to $300 a month with Uber.

Finally – don’t neglect the basics:

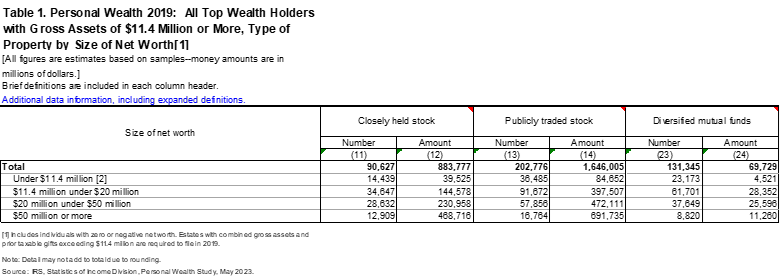

Of course, if you want to make real money you should probably consider investing seriously in stocks and real estate, as well as reduce your expenses by budgeting and saving like a fiend.

Additional Reading:

Finally if none of these ideas work you, and you’re in college consider reading Dollar Sanity’s list of ways to make money as a college student. Its geared for students, but its got some ideas that apply to everyone. They also have a good review article on this subject.

Kelan J. Kelan over at SavvyKlines also has another solid read on good ways to make money on the internet. Hustlingmoney.com has a good read on ways to make money with your body and Vital Dollar has a very good list of 150 side hustle ideas.