I’m presenting it here because most of what Franklin said in 1758 is still applicable today. Especially the themes of hard work and frugality.

Here are some notable quotes:

- “Beware of little expenses; a small leak will sink a great ship”

- “Gain may be temporary and uncertain, but ever while you live, expense is

constant and certain”. - “Sloth makes all things difficult, but industry all easy”.

Here is a text version of The Way To Wealth =>: https://liberalarts.utexas.edu/coretexts/_files/resources/texts/1758%20Franklin%20Wealth.pdf

At six pages long it is a short and helpful read.

For more of our great articles, read these:

Spyro Contogouris, The Story of A Hedge Fund Hitman

Ten Factors Affecting Your Wealth

Building Wealth On $600 Per Month

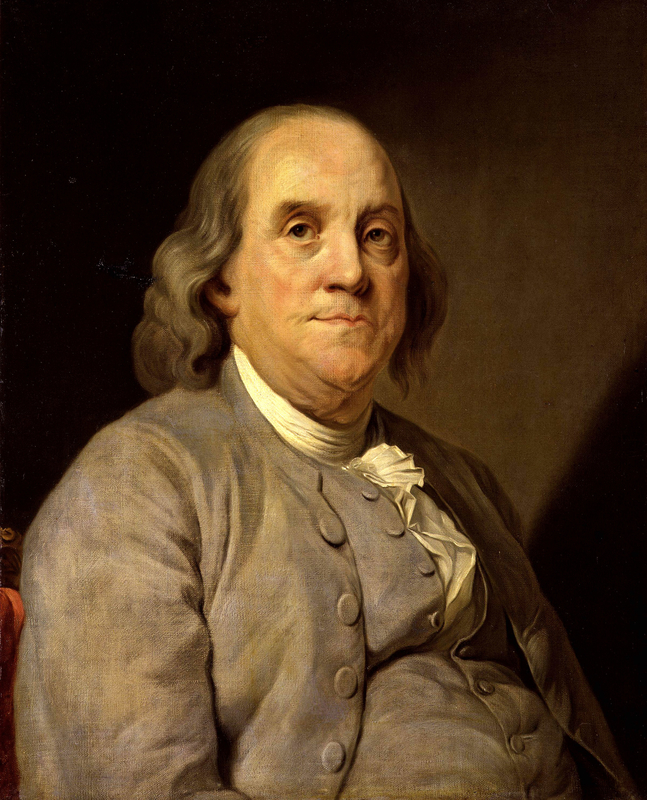

The original blogger, lol…

Heh, yeah man, Poor Richards Almanac was published semi-regularly for years. Its one of the ways that Franklin got influential. He had eyeballs on his stuff.