One great aspect of my marriage to Miel is that financial management in our relationship is a team effort. For example, over the past 6 months, we dealt with spending more than we earn, and got out of the ARMs on our apartment and our investment property. Because of this, we’re both feeling pretty good about the future.

So, over the course of the last week, we talked about what we wanted to do next. We decided to focus on contributing the maximum to our ROTH IRAs. The main idea is here is that putting as much as possible in our ROTHs will take advantage of the ROTH’s tax benefits (e.g. money deployed inside a ROTH compounds free of taxation).

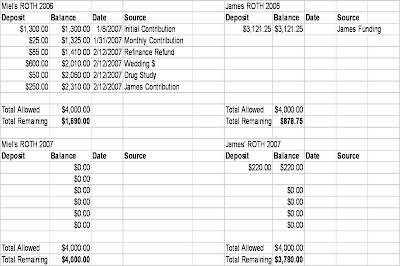

This means we’ve got to come up with $2,568.75 to complete our 06 contributions and $8,000 to complete the 07 contributions to our ROTHs. We’ve deposited some money in these accounts, but have more to do. Feel free to check out our spreadsheet below to see how much progress we’ve made and how much we have left to do.

Best,

James

No Comments yet!