The writing is on the proverbial wall — inflation and supply chain shortages are here. The news is covering it, and there is a lot of chatter about it in online forums.

The media is reporting that we’re likely to have a few more months of shortages and price increases. At this point, the Federal government is doing its best, but it got a lot on its plate. A quick fix to these inflation/supply chain issues is likely not going to be forthcoming. Inflation and shortages are atypical in the recent American experience, and as a result, most people don’t really know what to do about it.

For DINKS, here are four pro-active suggestions that might be helpful:

1. Stock Up:

Inflationary cycles tend to take a while to settle out — in some cases a couple of years. This means it’s likely that there will be several months of inflation in the future. This will probably impact grocery and consumer staples prices. A rational response to this would be to buy a couple of weeks’ worth of consumer staples, such as toilet paper, dry food (rice, beans, etc.).

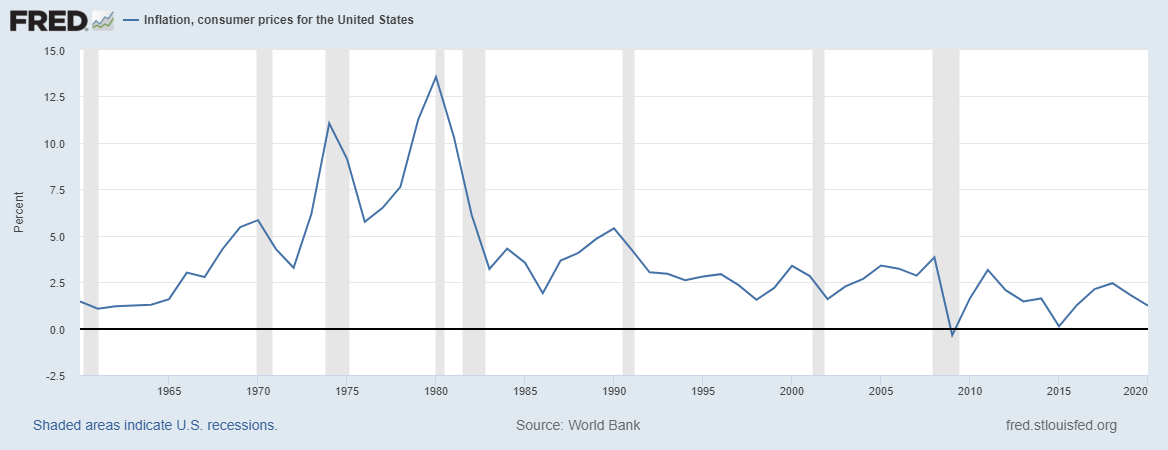

To illustrate, here are some U.S.-based inflation numbers from the last sixty years. The high inflation of the 1970s and 1980s didn’t recede for several months after their peak.

Source: St Louis Fed.

An excellent write-up of inflation, and how long it takes to settle, is here.

2. Stay Positive and Build Community:

The country is in the digital age; however, people who are part of tight in-person supportive communities do better when times are hard. Strong mutually supportive social ties almost always help in the long run. So if you’re not part of a community, you should consider thinking about strengthening your ties. Get involved with a religious community or join some clubs or business associations. At the least, pick up the phone and make plans to meet friends.

The Mayo Clinic has some more solid advice on building resiliency.

3. Buy Inflation Resistant Assets:

Another way to deal with inflation and supply chain shortages is to buy assets that are inflation resistant. If this appeals to you, here are a couple of options you could consider:

- Buying stocks

- Buying TIPS or I-Bonds

- Buying precious metals.

If you’re going to buy stocks, be sure you’re buying quality companies that have competitive advantages, pricing power, and cash flow consistency. Treasury Inflation-Protected Securities (TIPS) and I-Bonds are bonds sold by the U.S. treasury that pay interest based on the Consumer Price Index. So if inflation is high, they pay more interest. Lastly, precious metals (gold and silver) usually hold their value over time.

4. Keep A Eye Out For Opportunity:

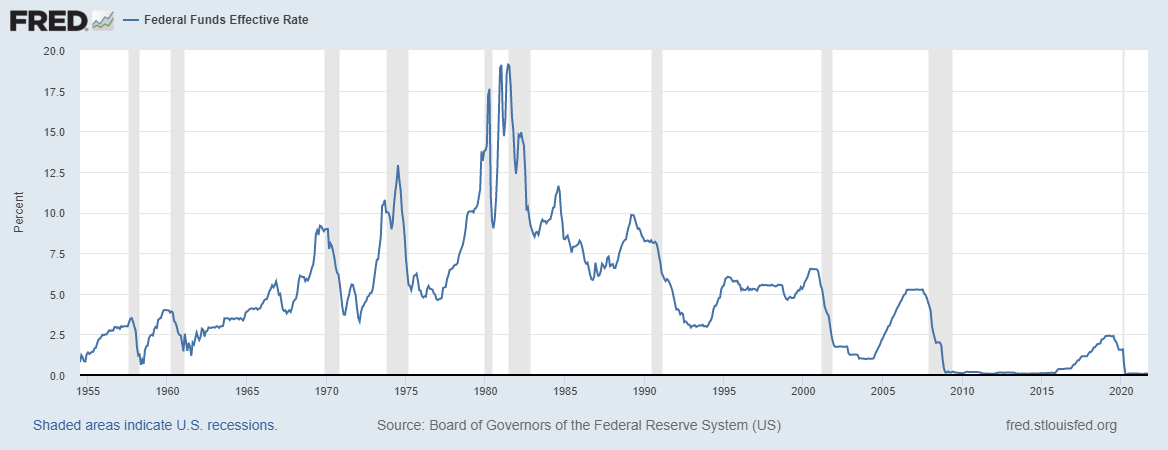

There are always opportunities to build wealth in environments with inflation and supply chain challenges, even in inflationary environments. For example, now would be an excellent time to start a California-compliant US-based trucking company. Short-term changes in interest rates can also present opportunities if you’re alert.

For example, during the 1980s, interest rates peaked at over 17 percent. That would have been an excellent time to purchase 30-year treasury bonds.

For more reading, consider the following:

This Saving Advice Forum’s Discussion on Supply Chains and Inflation.

The Equipped.org shortages thread.

Here is also a Bloomberg article on the global nature of the phenomenon.

If you’re talking about bonds. I’m definitely going to be buying I Bonds when the new interest rate kicks in. You’re not going to get a better rate anywhere. 7% is a great thing.

Yes, there are two Treasury products that might make sense – I bonds, and Treasury Inflation Protected Securities (TIPS).

I have some modest savings, which I might move into that account to get the interest rate.

I’m seeing a pretty substantial increase in the price of gasoline and food here in Oregon, and my bank account is yielding about zero in terms of interest, so safe alternatives make a lot of sense.