[Guest post today]

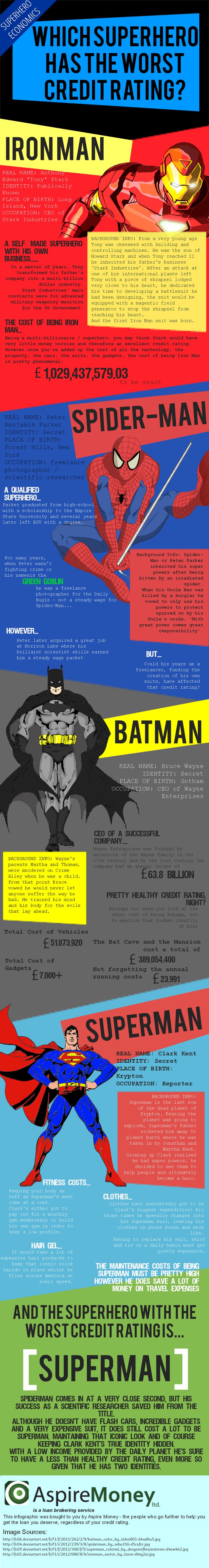

Even superheroes have to deal with the mundane parts of everyday life like credit ratings. Between saving their city or even the world, they need to make sure to pay their bills on time so that they can keep their financial reputation in order. If they don’t, they may be surprised to find out that they get an “A” in heroism, but a credit rating that makes it hard to even get the easy loans.

In the end, it’s not about how much these superheroes make or how much they spend. It’s about their debt ratios. How much debt are they carrying and can credit companies trust them with a loan? Even if they never need a loan, their credit rating could affect future job opportunities in this day and age. Good luck to them and us!

[Infographic shared by Aspire Money]Editor’s Note: How much people make, and spend, doesn’t determine their credit rating.

No Comments yet!