Folks,

For this posting I just wanted to hit on idea we’ve blogged about here in the past. This is the basic idea that owning stocks can have a substantial impact on your wealth.

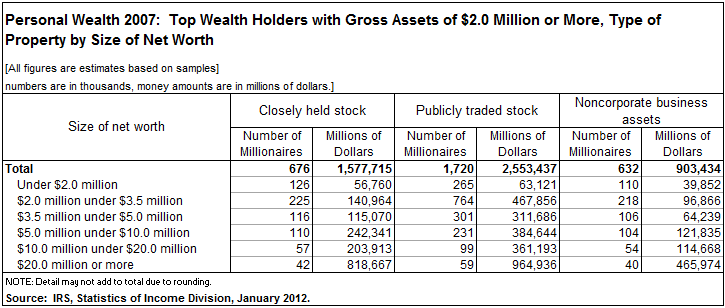

To illustrate the point I dug up some old 2007 data from the Internal Revenue Service. In 2007 the IRS did fancy mathematical study of estate tax returns to get a sense of what assets the wealthy in American own.

What the data shows is quite simple – if you look at the table you’ll see that stock ownership and net worth are positively associated. This means that as net worth increases, the amount of stock owned also increases. For example the data shows that all people with net worth between $0 and $2 million own about $56 billion worth of closely held stock and $63 billion worth of publicly traded stock. That’s a lot, but it’s nothing compared to the amount of stock held by those worth $20 million or more. Decamillionaires own about $818 billion of closely held stock and a titanic $964 billion in publicly traded stock.

Well…you might be thinking…of course they have all this, they’re rich people! They key point here is that stock ownership isn’t just associated with high net worth, owning stock can also cause you to get rich. Why?

1. Owning stocks means you get paid a dividend. This can be annually, quarterly, or monthly or along any schedule that’s been deemed best. Dividends are important for a number of reasons; first they are a form of mild passive income. Second, they can allow you to accelerate compounding (that is, when you reinvest your dividends in buying more stock).

2. You can borrow against stocks. A lot of lenders will let you borrow up to 50% of the value of your stocks. This depends partly on the quality of the stocks as well as on the lender’s internal policies. Why does this matter for your wealth? In a word: leverage. You could always take a loan against your stocks to start a business, invest in real estate or to avoid having to use your more expensive credit cards

3. Stocks increase in value. Not all stocks increase in value all the time, however the long term trend in U.S. equity markets has been positive. How positive? It depends, but the long term median annual return on the S&P 500 equity index is 15%. This is far better than many other asset classes.

4. Stocks mean ownership. Ownership means control. I have a friend in Oregon who runs a small software company. A while back he was able to get his hands on a micro-cap company which created software for restaurants. He did it by contacting the six owners in the company and buying 51% of the shares. Once he did that, the company was effectively his. He was able to seize control of the earnings. There wasn’t much in the way of profits – something like $2,000 to $3,000 per month which wasn’t being passed onto owners anyways. But the basic idea here is that when you own shares you own a company. With a controlling interest the earnings are going into my friend’s pocket.

Now, how does all this impact your wealth? Well, consider two guys. The first guy works hard at his 9 to 5 job. He leads a happy and fulfilling life but doesn’t choose to invest in stocks. He earns $50,000 annually. Not bad. The second guy works hard at his 9 to 5 job, but over time has been able to build up a stock portfolio worth $10,000. This yields perhaps 3% in dividends annually or $300 bucks. That’s a total of $50,300 income. The second guy is $300 richer than the first.

Of course the difference between the first and second guy isn’t that much in absolute terms. But $300 bucks in real terms can be a big difference. That’s 6 tanks of gas, 4 weeks of take-out lunches, 6 family dinners out, a sweet fish tank, or a new cell phone.

So what’s the point of all of this? Own stock. The rich do it, there are tons of reasons why stocks juice your wealth and even small amounts of stock can really help improve your finances.

If you’re interested in more on this topic, check out our other postings on the wonders of stocks:

No Comments yet!