Hi All,

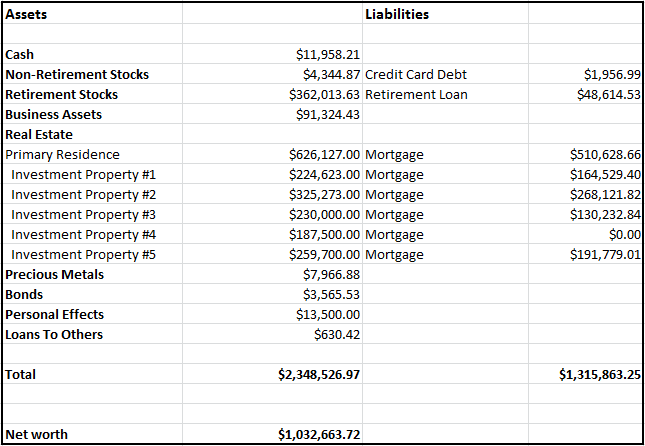

We updated our net worth this month. It looks like we’ve passed the one million threshold. This is terrific news. My wife and I have been seriously working at building our finances for over a decade, so its nice to see some payoff.

In terms of the major takeaways here – most of our gains have come from investing in real estate and maxing out our contributions to our 401k programs. The million figure isn’t necessarily all that firm This is because a lot of the assets on our balance sheet might have additional costs if we were to sell them. For example we’d likely have to pay 5 or 6% commissions to unload our real estate, but the nominal values are mostly right.

In terms of what has been working to build wealth we find that over time maximizing our retirement contributions, investing in stocks and purchasing income producing real estate have been the major drivers of our growth.

For more on high net worth bloggers, check out J Money’s ultimate listing of blogger net worths.

For our historical net worth, click here.

Dang man, congrats! That’s huge!

Thanks J. Congratulations on your Plutus!!!

What an achievement! May there be more who will be able to follow suit, hopefully including me. :))

Hey Jen – thanks a ton for stopping by and leaving a comment. I really hope that readers of this blog will take this number as an example. If you work at it, you can achieve financial freedom.

Nice work, I’m a huge proponent of real estate. What states are the rentals located in?

Hey Charlie,

Thanks for the note. The places are in DC and Oregon. DC has unfavorable conditions for investing. I would reccommend Virginia if you want to look at real estate in the DC area.

Thanks,

Jamed

Awesome work you two!!!

Hey Cat, Thanks for the note. Its always great to get the encouragement! Hope your week is going great.

Hey, I linked here through Budgets are Sexy.

How do you decide what value to assign to a property for the purpose of your balance sheet? I also have investment properties in the DC area, and I have had a hard time deciding what value to assign to them? (Cost, approximate true market value, some sort of zestimate)

RT,

Great question, thanks for stopping by and thanks for leaving a comment. We use zillow to estimate our properties. When they actually get appraised, say like when an appraiser makes an estimate as part of a refinance, then we will update the values at that time. But otherwise are using zillow.

Thanks,

James

I’ve been following Dinks for a few years. Congrats, Congrats, Congrats I’m so happy for you both!!!

Hi Leona,

Thank you for stopping by and thank you for the well wishes. I look forward to seeing you cross the million mark in the near future!

James

Pingback:The Million Dollar Club & Millionaire To-Do List! | Budgets Are Sexy

Pingback:Proof It’s Possible to Become a Millionaire | Budgets Are Sexy

Congrats on the million dollar mark! Hopefully your next million comes quickly.

How do you calculate your personal effects? Is that basicly your personal property. I have thought about including jewelry in my net worth but its very hard for me to determine how much I can really receive if I need to sell quickly.

Its very interesting to see how everyone calculates net worth.

Hey Continual,

Thanks for taking the time to comment. I would say – YES, add your jewelry to your net worth, but only if the jewelery is in fact something that you could easily sell (e.g. 24 carat gold or pure silver), and book it at something like 40% of retail- because that’s whats its really worth.

Congrats!!

I noticed it’s not the investment account that get you rich, but it’s the property that bring the number up. That’s why we are got to diversify. I’m looking to add 1 more investment property to my portforlio and call it good. But it’s nice to see regular people with regular income working diligently and reach the million dollars mark so early in life. It made me feel like I can accomplish this too!! You guy are very inspirational.

Hi Dinks. I am looking for a mentor. You would be the right person. Congratulations

Elisha,

Don’t listen to us on this. I would check out Peter Voodt’s 6 months to 6 figures if you want to figure out how to make yourself more effective, efficient and richer.

Thanks,

James

Pingback:How does money change you? - DINKS Finance | DINKS Finance