Doomsday did not come on May 21. However, that didn’t stop people, the followers of Harold Camping, from giving away their entire life savings to Harold Camping in hopes of eternal rapture. I thought these stories were crazy, but maybe that is just me. If you thought that the world was definitely going to end how would you spend your last few days alive on Earth?

Harold Camping is a self proclaimed Doomsday profit who predicted that the world would end on May 21 with a series of fatal natural disasters. He has tens of thousands of fans and followers who tune in to his radio show that is broadcast on more than 50 different radio stations.

A San Francisco Newspaper reported that followers of Harold Camping quit their jobs, sold all of their personal possessions, and spent their (supposedly) last few days on Earth taking luxurious vacations. Other sources reported that people stopped paying their bills, sold their homes, and even committed suicide prior to the predicted events on May 21 in order to avoid a possible painful death.

I personally don’t believe that anyone can predict the exact date and time that the world will end. However if it comes down to it, here are a list of things that I would and definitely would not do if it was the end of the world.

Five Things That I Would Not Do:

- I would not quit my job. If it really was the end of the world no one would have need for a bank or a financial planner and therefore I am sure the bank would be closed.

- I would not make plans for the future (just in case). The lists of things to do in my life would definitely stop.

- I would not sell my house, because no one would need it. If it really was the end of the world it would definitely not be a seller’s market.

- I would not spend all of my life savings because there wouldn’t be enough time for me to enjoy the money. If I was going to spend my lifesavings it would be to travel around the world and experience new things, and there just wouldn’t be time for that.

- I would not give away my money. Nobody would need it if we are all going to be dead in a week. I am not sure why people gave their life savings to Harold Camping because if the end of the world was supposed to be May 21st he would have no need for the money.

Three Things That I Would Do:

- I would spend time with my family. In case it really was the end of the world I would like my last moments to be spent with loved ones.

- I would make peace with all of my personal troubles and inner demons. No one is perfect but I would ask for forgiveness before I enter into the afterlife.

- I think that I would hope and pray that it really wasn’t the end of the world because there is still so much more that I want to do in my life. However, I would also pray that I wouldn’t suffer during the rapture and that I would be with my family in the afterlife.

Preparing for the end of the world is definitely different than preparing for our own death. We don’t need to get all of our finances and insurance policies in order because there is no one left behind.

How would you spend your last days on Earth before the end of the world?

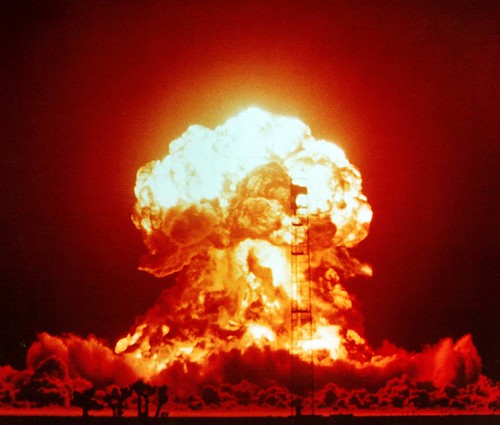

Photo by CTBTO

I think your reasoning is really sound and I too would want to spend my remaining time with loved ones. I don’t understand why blowing all of your money at the last minute is an appropriate way to prepare for some sort of religious enlightenment. Is that really what Harold Camping’s followers’ religion is supportive of?

No Debt MBA I definitely agree. I am not sure why people feel that gifting or spending their money is a valuable way to spend their last days on Earth. I read in various sources that some of Harold Camping’s followers spent their money down to the very last dime, and some others actually gifted all of their money to Camping in hopes of “eternal peace”. It is definitely not my mentality.

Awesome post. Interestingly I would have chosen the same path you would. While it would be great to experience some of things that I haven’t done yet I think I would want to cherish the time with my loved ones above everything else. I think this is a great reminder in general to not take our loved ones for granted.