With the continuous announcements of layoffs across the country I thought it was appropriate to voice my gratitude for experiencing only a brief two months of unemployment. With the severance I was given I never even had to go without a pay check for that time.

Not only was my unemployment brief, I also found exactly what I was looking for, doing exactly what I love. In fact, I’ll be headed to the Democratic Republic of Congo tomorrow for at least a month. I have a boatload of management issues to tackle during that time, but it feels great to be doing what I love and what I am good at.

For those who are reading that are unemployed or might know someone who is, keep in mind the power of positive thinking. I know it might sound corny, but it can make a world of difference. James noted that upon my return from Afghanistan I was at times a bit pessimistic about finding the right job for me.

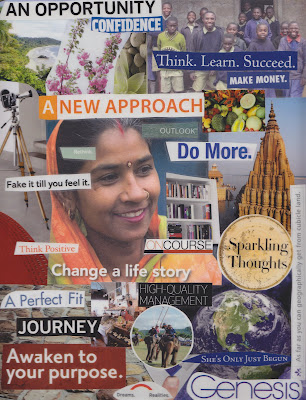

I decided that if I was going to find what I wanted, that I had to define it well. I wrote out a wish list of all of the things that I wanted in my new job, including what I wanted to be paid. I also did an artful collage with cut outs from magazines expressing aspects of my dream job. This included travel, grounding in DC, and various things about positive thinking; see below.

The next morning, I found the job that I now have. I looked at the advertisement a bit stunned, as it fit my skill set and wish list to a tee. The interviewing process went smoothly and I was hired on the exact day I would have chosen to start work, making exactly what I wanted as well. Now with nearly a month on the job it couldn’t have been a better fit.

I feel that my focus on what I was interested in gave me the edge on staying positive and recognizing what I wanted for myself. Hopefully others might get similar results. Just remember to be careful for what you wish for!

Cheers,

Miel

No Comments yet!