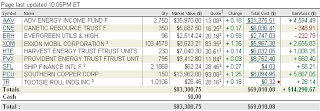

Our last few posts have been about credit cards, but as you know having a strong personal financial situation involves more than just borrowing. It also means having a healthy level of assets. In order to amuse our readers, we wanted to show you what stocks we are holding as well as the performance of each of our securities.

In looking at these, we tried to balance our need for income with the prospect for growth that stocks can provide. So, some of the companies we bought for the dividends they pay. Others we bought because we thought the company’s shares would increase in price. For example, AAV, CNE, ERH, HTE, SLF and PCU we all bought for the dividends.

On the other had, some of our stocks, such as XOM, SSS, PRU and MAR we bought because we had an expectation that the stock’s price would increase. In the case of XOM, we’re up approximately 60%. MAR, SSS and PRU have also done pretty well, but not as well as Exxon.

On the other had, some of our stocks, such as XOM, SSS, PRU and MAR we bought because we had an expectation that the stock’s price would increase. In the case of XOM, we’re up approximately 60%. MAR, SSS and PRU have also done pretty well, but not as well as Exxon.

There’s plenty of junk in our portfolio also. For example, we’ve got 1 share of Tootsie Roll Industries (TR). This was a dividend share I got a couple of years ago, but haven’t sold because the commission would eat up a third of the value. TR hasn’t really gone much of anywhere in years, but we’re holding because who knows what might happen in the future.

There’s plenty of junk in our portfolio also. For example, we’ve got 1 share of Tootsie Roll Industries (TR). This was a dividend share I got a couple of years ago, but haven’t sold because the commission would eat up a third of the value. TR hasn’t really gone much of anywhere in years, but we’re holding because who knows what might happen in the future.

As a final point, the yield from our dividend stocks is giving us approximately $870 a month pre-tax. I did the math in an earlier post, but I think whats revealing about this is its possible to successfully balance both growth and income if you have a sufficiently sizable portfolio.

I hope that your investing career has been as rewarding as ours!

Best,

James

No Comments yet!