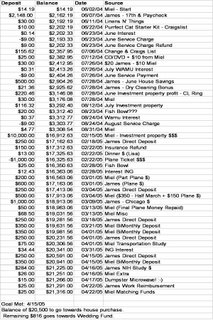

One thing about finance blogland is there is a lot of talk about saving, but fewer examples of how people actually do it. If you’re a frequent reader of Dual Income No Kids, you know that we are homeowners. When we were saving for our place, we kept a record of where our savings came from. We thought you might enjoy having a look at this.

We did all kinds of stuff to meet our savings goals. For example, we set up direct deposit into ING, sold things on craigslist, put money from family into the fund, profit from our investment properties, pretty much anything to meet the goal. One time we found a working microwave in the dumpster, cleaned it up and sold it.

Some things weren’t that great. For example, James bounced a check because of some carelessness and we had to juggle the savings to cover his airfare for a work function at one point. The money got made up, but generally its a good idea to keep personal checking and savings accounts separate.

Also, we switched from a Washington Mutual to an ING savings account halfway through the process. ING has much lower monthly fees and pays a much higher interest rate.

Hope you enjoy!

p.s. We had to truncate some of the lines to get the photo to fit, so the numbers don’t necessarily add up in the middle.

Pingback:assets and saving, saving helps build assets, real estate profits, real estate savings, multifamily property, saving, investing, reinvesting | DINKS Finance

Pingback:Save Your Money People - Save Your Money - Dual Income No Kids | Dual Income No Kids