Insurance companies set prices based on risk, and are increasingly embracing technology that helps make weather predictions.

These tools aim to rein in losses amid the growing frequency of extreme weather events that have forced insurers to make bigger and more frequent payouts on benefit claims.

Insurers typically raise premiums after a policyholder makes a claim. But when a major disaster strikes, multiple large claims come from the same geographic area. As these events continue to set new records in severity, the damages also keep getting more expensive.

Speaking of more expensive damages from hurricanes Harvey and Irma were estimated to reach $50 billion (that’s actually down from an earlier estimate of $200 billion in direct costs and total economic impact approaching $3 trillion).

Even after accounting for homeowners who lack flood insurance, the amount of money insurers have to shell out on claims in storm-affected areas will require higher premiums and deductibles to keep the insurers’ books balanced. For more information.

Homes in areas with higher risks for extreme weather become more expensive to insure — with every new record set, the premiums, and deductibles in the affected region all go up.

Even newcomers who move to the area can encounter high premiums and deductibles that more than offset anything saved on otherwise depressed home prices following a post-disaster exodus.

The Meaning of Expensive

Many homeowners and renters have foregone buying insurance for flood or earthquakes because the policies nearly always cost substantially more than the original policy on the home. However, the real meaning of expensive becomes apparent when these homes get hit by the type of disaster they don’t have insurance for.

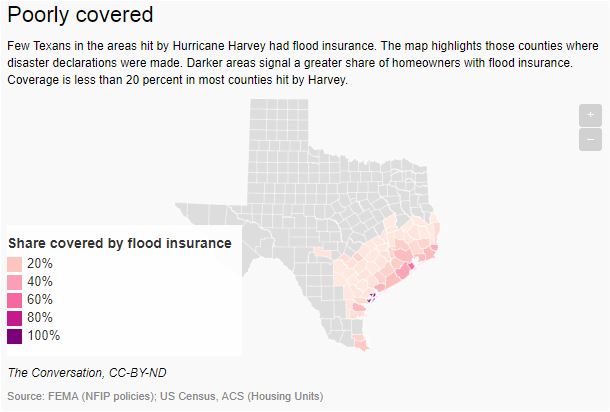

Actually, 80% of hurricane Harvey victims lacked flood insurance and as a result, face having to pay for a lot of the damages out of their own pockets. While homeowners insurance includes coverage for wind damage, good luck convincing an insurance claims adjuster to consider wind as the cause of home flooding.

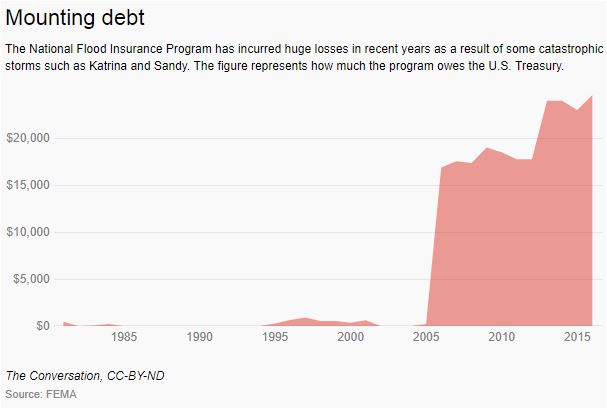

Both flood insurance and earthquake insurance are provided by government subsidized entities — that are actually still underwater from payouts made to hurricane Katrina victims, according to the Federal Emergency Management Administration.

While the premiums and deductibles are likely to keep escalating to points even higher than what many homeowners might feel like they can afford, the alternative can be even less so should tragedy strike.

What Should Homeowners Do?

However, it may be possible to lower the premiums and deductibles on homes in at-risk areas by improving infrastructure in ways that would protect against natural disasters.

This might include elevating a home’s foundation in a flood region or bolting down and reinforcing the foundation in earthquake territory.

Otherwise, the alternative amounts to attempting to move away from something you can never really escape. It’s one thing to deny the existence of climate change, but no one is denying that the weather is getting more extreme even in locales that used to be known as temperate.

Alas, moderate climates might be turning into a thing of the past, at least until something changes, requiring homeowners to find a way to budget more money for insurance or invest in damage prevention.

Pingback:You Might Be Underinsured. Ethos Can Fill in the Gaps. - Dual Income No Kids | Dual Income No Kids